AFIP Form 3283: Paying Taxes in Argentina when Selling Real Estate

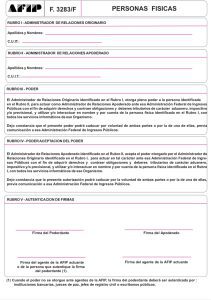

AFIP Form 3283/F – Personas Físicas or Form for Physical Persons

Form 3283/F is the form issued by AFIP that all foreigners and non-residents must complete and sign in order to substitute an Argentine tax payer in their tax obligations -this applies if you are a lawyer, a certified public accountant (CPA), or simply the attorney in fact of a foreigner or a non-resident who wants to sell real estate but requires formal permission from AFIP in order to sell. If you are filling-out this form to empower a third party to represent you with a PoA in the sale of real estate, the form should be filled-out in the exact same way.

Again, the purpose of this form is so that a person (attorney in fact) empowered by the applicant can represent the applicant in being compliant with their Argentine tax filings so that they can sell the real estate that they own in Argentina. In order to do this the applicant must first pay any taxes before AFIP will allow the applicant to sell any real property that they may own. 🇦🇷🇺🇸

Here is the form which can be downloaded directly from AFIP’s website:

http://biblioteca.afip.gob.ar/pdfp/rg_2288_afip_3283f.pdf

How To Fill-Out and Complete This Form

1. RUBRO I: [Administrador de Relaciones Originario]:

Starting on the first line where it says “Apellidos y Nombres”, the applicant must complete the full name of the person who is applying to be substituted in their tax responsibilities. The full name must be written starting first with the last-name followed by a comma and the first and middle names thereafter. This is the format to follow: Last-name, First-name & Middle-name. Example, “LIMERES, Sebastian Benicio” if the full name was “Sebastian Benicio LIMERES”).

In the line below, staying on the same box in RUBRO I a CUIT, CUIL or CDI Number should be entered. These three different categories come all in the same format: XX-XXXXXXXX-X [Two numbers – Eight numbers – One number]. “22-88888888-1”. Foreigners and non-residents are always assigned a CDI and not a CUIT or a CUIL.

CUIT: Clave Única Identificación Tributaria. This number is for employers and people who work independently, not employees.

CUIL: Clave Única Identificación Laboral. This number is strictly for anrgentine employees.

CDI: Clave de Identificación. [**This is the number that foreigners and non-residents are assigned as it’s only to pay taxes since they may have never worked and paid taxes in Argentina**]

The line for the CDI/CUIT/CUIL must be left blankas AFIP will assign the applicant a CDI number, therefore AFIP will complete it on the day in which an argentine CPA submits the entire file for the applicant. This of course, applies only if the applicant still doesn’t have a tax number (CUIL, CUIT, CDI). If the applicant already had a tax identification number AFIP will decide to extend a new one just for this specific real estate sales transaction. This number in Argentina is equivalent to a SSN / Social Security Number in the USA. Same as in the USA as well as most countries. These numbers are strictly for tax and social security purposes and not much else.

2. RUBRO II: [Administrador de Relaciones Apoderado]:

In this section, the same rules apply as in RUBRO I in terms of how the last-name must be entered first. This shoulde also include the first and middle-name right after. In RUBRO II, type the full-name of the person who will act as the power of attorney. Also, include their CUIT number. For instance, if LIMERES will be processing this certificate, the information that must be entered here is of one of our attorneys full name as well as their CUIT number. We can provide that information upon your request. Contact Us

3. RUBRO III: [Poder]: This is the translation in English of what RUBRO 3 states in Spanish:

The Original Relationship Administrator identified in Item I, grants full power to the person identified in Item II, to act as Administrator of Proxy Relations before that Federal Administration of Public Revenues in order to acquire rights and incur tax obligations and duties of a customs, tax and/or social security nature, and use and/or interact on behalf of and on behalf of the natural person identified in Item I, with all the computer services of that Agency. I hereby state that this power of attorney may expire by the will of both parties or by that of one of them. Prior notification to that Federal Administration of Public Revenues.

4. RUBRO IV: [Poder-Aceptacion del Poder]:

This is the translation in English of what RUBRO 4 states in Spanish:

SECTION IV – POWER ACCEPTANCE OF POWER

The Proxy Relationship Manager, identified in Item II, accepts the power granted by the Original Relationship Manager identified in Item I. To act in such capacity before that Federal Administration of Public Revenues in order to acquire rights and incur obligations, and tax duties of a customs, tax and/or social security nature. Use and/or interact in the name and on behalf of the natural person identified in Item I, with all the computer services of that Agency. I certify that this authorization may expire by the will of both parties or by one of them. Prior notification to that Federal Administration of Public Revenues.

5. RUBRO V: [Autenticación de Firmas]:

On this last section of the document four signatures will be required in the following order:

Above on the left side: PODERDANTE. This is where the applicant signs.

Below on the left side: NOTARY. This where the notary signs.

Above on the right side: APODERADO. This is where the attorney in fact representing the applicant must sign.

Below on the right side: AFIP. This is where an AFIP agent must sign.

AFIP Form 3283: Paying Taxes in Argentina when Selling Real Estate

When signing a document in the USA or any country overseas/abroad, meaning outside from Argentina, the notarization, apostille, or legalization must be done at an Argentine consulate.

However, for documents in Argentina, the presence of a notary public is mandatory. Otherwise, some type of formal authority that can legally authenticate the signature of those who are signing.

Contact LIMERES for a consultation or to get a quote:

WhatsApp:

https://Wa.me/19257918555

and/or

https://wa.me/5491141620021

By email: YouTube@Limeres.com

USA: +1 (925) 791-8555

ARG: +54911 4162-0021